Top Equity Loans for House Owners: Obtain the very best Prices

Top Equity Loans for House Owners: Obtain the very best Prices

Blog Article

The Leading Reasons That Home Owners Choose to Secure an Equity Financing

For many home owners, choosing to safeguard an equity car loan is a calculated monetary decision that can offer different benefits. From consolidating financial obligation to taking on significant home remodellings, the reasons driving people to opt for an equity car loan are impactful and diverse (Home Equity Loans).

Debt Loan Consolidation

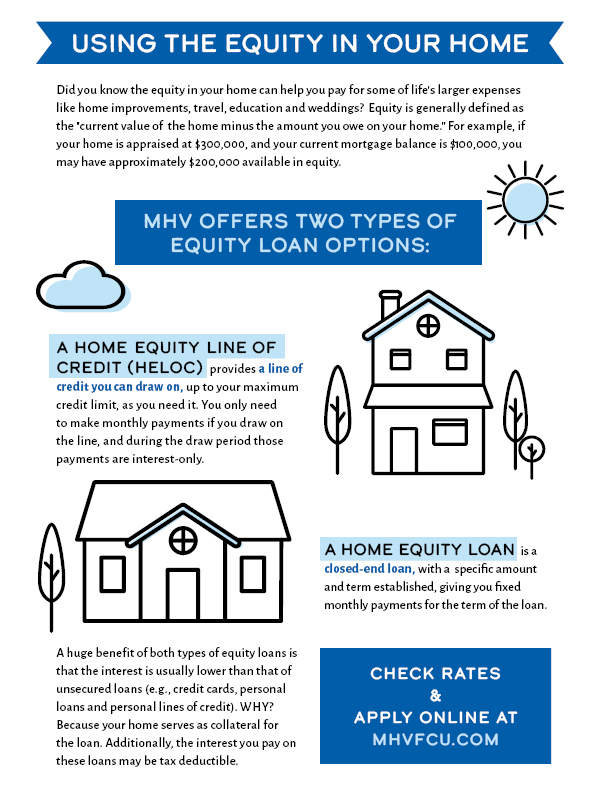

Homeowners usually go with safeguarding an equity funding as a calculated financial action for financial obligation loan consolidation. By leveraging the equity in their homes, people can access a swelling sum of cash at a reduced rates of interest compared to various other kinds of borrowing. This capital can then be utilized to pay off high-interest financial debts, such as bank card balances or personal car loans, enabling homeowners to simplify their monetary obligations into a solitary, more workable monthly repayment.

Debt debt consolidation via an equity funding can offer numerous benefits to property owners. The reduced interest rate associated with equity lendings can result in considerable expense savings over time.

Home Enhancement Projects

Considering the enhanced value and functionality that can be accomplished with leveraging equity, many people decide to allot funds in the direction of different home renovation jobs - Alpine Credits Home Equity Loans. Homeowners usually select to secure an equity financing specifically for renovating their homes because of the considerable returns on financial investment that such tasks can bring. Whether it's updating obsolete attributes, broadening living areas, or improving power effectiveness, home enhancements can not just make living spaces much more comfortable but additionally raise the general worth of the property

Typical home improvement projects moneyed through equity car loans include kitchen remodels, restroom remodellings, cellar ending up, and landscaping upgrades. These tasks not only boost the quality of life for house owners yet also add to enhancing the visual appeal and resale worth of the building. Additionally, purchasing high-quality materials and modern design components can better raise the aesthetic allure and capability of the home. By leveraging equity for home improvement tasks, house owners can create areas that better match their requirements and preferences while additionally making a sound financial investment in their residential or commercial property.

Emergency Costs

In unexpected situations where instant monetary aid is required, protecting an equity funding can provide property owners with a viable option for covering emergency costs. When unexpected occasions such as medical emergencies, immediate home repair work, or unexpected task loss arise, having accessibility to funds with an equity funding can provide a security internet for home owners. Unlike other types of loaning, equity fundings usually have reduced interest rates and longer settlement terms, making them a cost-efficient option for dealing with instant financial needs.

Among the key benefits of utilizing an equity lending for emergency costs is the speed at which funds can be accessed - Alpine Credits Canada. House owners can rapidly use the equity accumulated in their property, allowing them to attend to pressing financial issues immediately. Additionally, the versatility of equity loans allows property owners to obtain only what they need, avoiding the worry of taking on excessive debt

Education Funding

Amidst the quest of college, safeguarding an equity car loan can function as a calculated monetary resource for house owners. Education financing is a significant worry for several family members, and leveraging the equity in their homes can provide a method to accessibility necessary funds. Equity financings typically supply lower rate of interest prices compared to other types of loaning, making them an appealing choice for financing education costs.

By using the equity developed in their homes, homeowners can access significant amounts of money to cover tuition charges, publications, accommodation, and other related prices. Equity Loans. This can be particularly useful for parents aiming to sustain their kids with college or individuals seeking to advance their own education and learning. Furthermore, the interest paid on equity loans may be tax-deductible, providing possible financial advantages for debtors

Inevitably, utilizing an equity financing for education funding can assist individuals invest in their future earning potential and career development while efficiently managing their economic obligations.

Investment Opportunities

Conclusion

In conclusion, house owners pick to safeguard an equity financing for numerous reasons such as debt consolidation, home improvement tasks, emergency situation costs, education and learning financing, and investment possibilities. These financings offer a means for homeowners to gain access to funds for essential economic requirements and objectives. By leveraging the equity in their homes, home owners can take benefit of lower rate of interest and flexible payment terms to achieve their monetary goals.

Report this page